Corporate governance

Contribution to SDGs objectives

The Group has identified three materialities related to governance: "corporate governance," "compliance," and "fair business environment." The Group is committed to upgrading its corporate governance system and, through ongoing dialogue with its stakeholders, is committed to honest corporate governance trusted by society.

Our approach to corporate governance

The Group strives to improve shareholder value stably in the long term, recognizing that strengthening corporate governance is essential for the continuous improvement of corporate value.

Respecting all the shareholders, the Group strives to achieve shareholder value stably in the long term and enhance its soundness and transparency. To this end, the Group will strengthen corporate governance by establishing a swift and rational decision-making system and an internal system that enables efficient execution of operations.

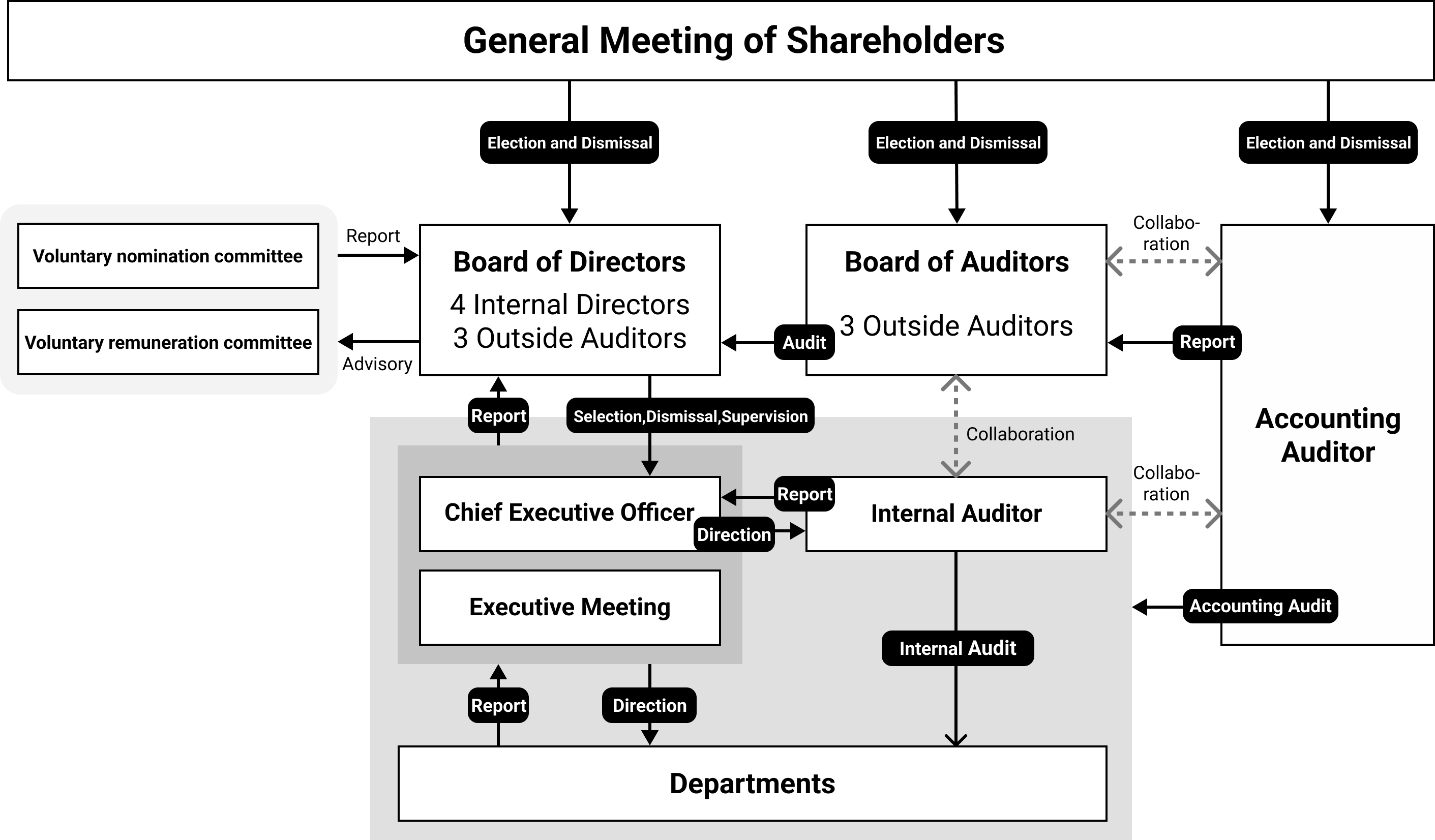

Structure

Board of directors

The Company's Board of Directors consists of seven members (six male and one female), including three independent outside directors with extensive work experience and deep insight.

In addition to the regular monthly Board of Directors meetings, extraordinary meetings are held as necessary.

The Board of Directors will continue to make important management decisions and supervise the execution of operations by each director.

Board effectiveness assessments

The Company conducts analysis and evaluation of its board of directors' effectiveness to strengthen the board's functions further. The results of the assessment of the effectiveness of the Company's Board of Directors for the fiscal year ended December 31, 2024, showed that the composition and operation of the Board, director compensation and nominations, and training for the Board were generally appropriate and that the Company's Board of Directors had a solid commitment to the Company's business operations. The Company confirmed that the effectiveness of the Board of Directors is sufficiently ensured. Based on the results of the questionnaire-based evaluation of the effectiveness of the Board of Directors, the Chairman of the Board of Directors and the Secretariat of the Board of Directors will further enhance the effectiveness of the Board of Directors by focusing their efforts on the following points.

- Further acceleration of distribution of board meeting materials

- Enhance training for board members

- Provide opportunities for mid- to long-term discussions, including succession planning

Board of auditors

The Board of Corporate Auditors holds a regular meeting once a month and extraordinary meetings as necessary to share information among the Corporate Auditors, including the formulation of audit plans and the status of audit implementation.

In addition to attending the Board of Directors and other important meetings, the Corporate Auditors also inspect important documents, ask questions of officers and employees, and perform further audit procedures by the audit plan to ensure proper monitoring of management. They also work closely with the Internal Audit Office and accounting auditors to improve the effectiveness and efficiency of audits.

Nominating and compensation committee

The Company has established the Nominating Committee and the Compensation Committee as voluntary advisory bodies to the Board of Directors regarding nomination and compensation to strengthen the fairness, transparency, and objectivity of procedures related to directors' nomination and compensation and enhance corporate governance further. The Board of Directors decides the nomination and remuneration of directors based on the reports of each committee.

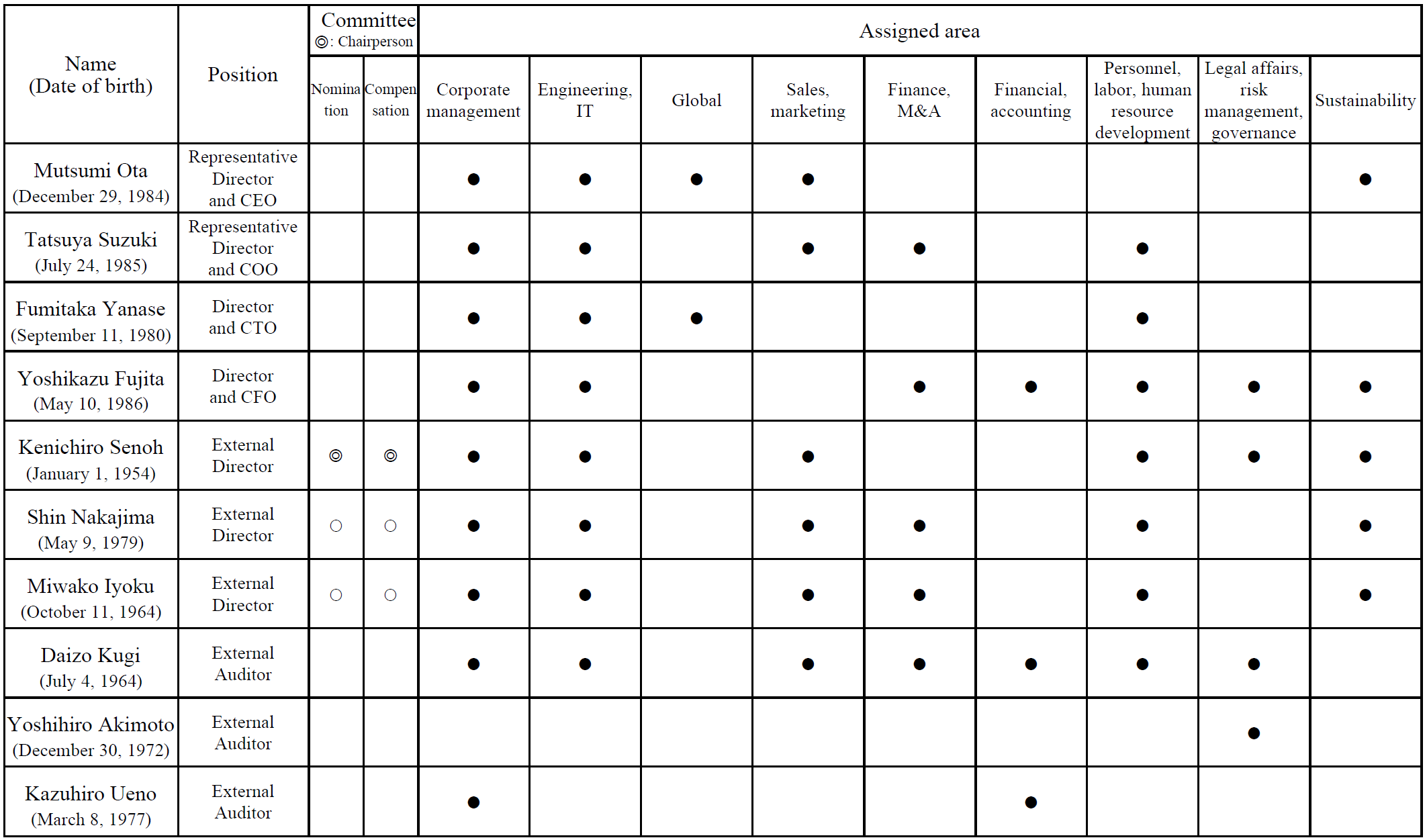

Director appointment policies and procedures

Basic policy

In selecting candidates for the Company's Board of Directors, the Company places importance on the candidates' understanding and sympathy for the Company's vision, mission, and corporate culture, their necessary insight and fairness as directors, and their ability to contribute to the Company's sustainable growth and development and medium- to long-term corporate value enhancement, regardless of gender, age, or nationality, etc. The Company selects its directors based on its established criteria for selecting directors and the composition of its Board of Directors.

Appointment procedures

The Company selects candidates based on its policy regarding the composition of the Board of Directors and the criteria for selecting directors and executive officers established by the Company, and the Nominating Committee, a voluntary advisory body to the Board of Directors, deliberates on the candidates before the Board of Directors makes a decision.

Skill Matrix

Policies and procedures fordetermining director compensation

Basic policy

The Company's basic policy for the compensation of its directors is to compare the compensation systems and compensation levels of companies similar to those of the Company in terms of size, industry, and business category with those of the Company's current systems and compensation levels, and to determine a compensation system that will fully function as an incentive to increase corporate value continuously, and to determine the compensation of individual directors at an appropriate level based on their respective responsibilities.

In determining the compensation of individual directors, the Company's basic policy is to set an appropriate level based on the responsibilities of each position. Precisely, compensation consists of basic compensation (monetary compensation) and stock compensation (restricted stock compensation). The purpose of restricted stock compensation is to provide medium- to long-term incentives to maximize shareholder value and further share value with shareholders.

In light of their duties, outside directors, who are responsible for the supervisory function, are paid only the basic remuneration.

Procedure for determining compensation

Specific details such as the amount of compensation for each individual are determined by the resolution of the Board of Directors after deliberation by the Compensation Committee, which is established as a voluntary advisory body to the Board of Directors, on the composition, level, maximum total amount, etc. of compensation.

Anti-corruption policy

The Group considers the recent increase in global awareness of bribery an essential factor in achieving sustainable growth of its domestic and overseas business.

To avoid the following corrupt practices, the Company Group will consider, establish, and continuously improve appropriate anti-corruption management systems following the characteristics and risks of each country or region.

- Giving Bribery

- Facilitation payments

- Accepting Bribery

- Illegal entertainment and gifts

- Insider trading

We shall also establish and maintain the following appropriate systems based on the policy.

(1) Records and Retention

All officers and employees shall comply with procedures for financial reporting, accurately record all transactions in the accounting books, and properly store related documents.

(2) Audit

The Company shall appropriately operate a system of self-inspections and internal audits of compliance with internal rules established based on the Company's anti-corruption policy by the degree of risk.

(3) Establishment of a hotline for reporting corruption

To ensure compliance with the Group's Anti-corruption Policy, the Company has established a hotline where officers and employees can report general compliance issues, including anti-corruption matters. To protect the privacy of the individual, anonymous reporting and consultation are permitted.

The hotline is assigned a person responsible for managing and supervising the operation of the contact. The person in charge works on problem-solving measures and recurrence prevention measures. Suppose the content of the report or consultation is deemed necessary. In that case, the content of the report or consultation is promptly reported to the Board of Directors while ensuring the anonymity of the person making the report or consultation, and the Company takes action.

The Group will also request cooperation from its business partners to prevent corruption.

Internal training on ethical standards

The Group stipulates compliance with laws, regulations, internal rules, and corporate ethics in its Compliance Regulations. It conducts periodic training sessions for all officers and employees on the relevant laws and regulations to ensure thorough compliance.

Risk management

The Company has established "Risk Management Regulations" and a company-wide management system to appropriately manage various risks that may hinder the Company's efforts to maintain sound management, drive its business forward, and enhance its corporate value.

In addition, to appropriately and promptly respond to risks that could have a significant impact on management, the company has established a Risk Management Committee chaired by the CFO, responsible for the Corporate Division to recognize and identify risks that must be addressed in the course of business activities, including sustainability-related risks, and to discuss countermeasures.

The Risk Management Committee plays a central role in analyzing and understanding the significant risks identified and integrating them into company-wide risks to reduce and prevent them.